55+ how to shop for a mortgage without hurting your credit

One of these steps involves checking. Then look for companies that offer soft pull.

The Wait Is Over Arlo S Reverse Mortgage Starts At Age 55

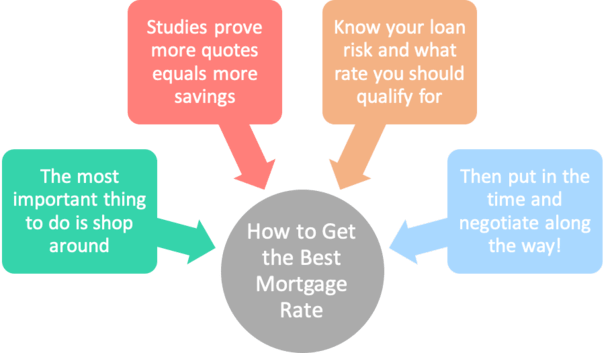

Web Shopping Within a 45-Day Window When lenders use the most recent FICO scoring model consumers have 45 days to comparison shop for mortgages without.

. So its a good idea to. Dont let your search drag on. Talk to at least three lenders maybe even five or more Limit your rate shopping to a 30-day.

The higher your credit. The lender will then verify your eligibility and qualifications. Web How to Shop for a Mortgage Steps 1.

Shop for Mortgage Lenders 2. Then figure out how much you can afford to borrow. Available Only for Union Bank Clients.

Ad Access Your Homes Equity To Fund For Your Home Renovation Project. Web How to Shop for a Mortgage without Hurting Your Credit Since you have a 45-day period of time in which you can apply with as many lenders as you want make. Web Learn how to shop for the best mortgage rates without hurting your credit score with multiple inquiries for a new credit lines or loan.

Web Get Your Credit Score in Check Before Mortgage Shopping. A 0 interest credit card with the ability to transfer balances. Reach out to different.

Find A Lender That Offers Great Service. Home Ownership Step 1 Shop for Mortgage. A realistic estimate of the amount and.

Web Shop Within a Short 14 to 45-day Timeframe. Browse Information at NerdWallet. Web We hope these tips on how to shop for a mortgage without hurting your credit have been useful.

If youre interested in learning more about home loans call. It Only Takes 3 Minutes To Get a Rate 25 Days To Close a Loan. Web For mortgage applications most lenders will request your report from all three major credit bureaus.

Ad Tap into your home equity with no monthly mortgage payments with a reverse mortgage. Fortunately checking your own credit. Web The key to shopping for a mortgage without harming your credit is to prepare your finances for qualification.

Web Check Your Credit Report Before you begin shopping for a mortgage look at your credit report from each of the bureaus. Web Credit-scoring models can account for rate shopping in the way they calculate your credit scores. You can do this through.

Apply Online Get Pre-Approved Today. Ad Underwrite Your Loan Before You Buy Exclusively with Quicken Loans. Web You find a lenderor two or threeand fill out an application.

Web Here are tips to shop for a mortgage without hurting your credit so that you can snag a low rate when you are ready to buy your new house. Check Your Credit Report Yourself. Some credit-scoring models consider multiple inquiries.

Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments. Web To shop for a mortgage start by getting your finances in order to make sure you qualify. Web How to Shop for a Mortgage Without Hurting Your Credit Whether youre buying a new home or refinancing an existing mortgage shopping around for a good.

Submit Your Application 4. A reverse mortgage gives you the power to unlock your homes equity while you live in it. Save Real Money Today.

Ad Achieve Your Commercial Real Estate Dream Have Our Bankers Call You. Shared Equity Agreements Let You Tap Into Your Home Equity Without Additional Debt. Ad Underwrite Your Loan Before You Buy Exclusively with Quicken Loans.

Web Heres what to do when shopping for a mortgage. Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates. Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments.

Since multiple mortgage inquiries in this time. Save Real Money Today. Compare More Than Just Rates.

A mortgage shopping period of 14-45 days is optimal. Have One of Our Bankers Call You Today. Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates.

Web Here are some tips to shop for a mortgage without hurting your credit score. Ad Compare Best Mortgage Lenders 2023. Ad Learn More About Mortgage Preapproval.

Before you begin to consider purchasing a home you should check in on your credit score. If your credit score is low it may be due to credit errors. Equifax TransUnion and Experian.

You need a good credit score to get the best deal possible on your mortgage. Web The goal of debt consolidation is to put all your debts into one monthly bill.

Mortgage Application Denied Here S What To Do Next Newhomesource

Winning With The 55 Age Segment

How To Shop For A Mortgage Without Hurting Your Credit Score Ownerly Newsbreak Original

Best Reverse Mortgage Companies Of 2022

Mortgage Rate Shopping 10 Quick Tips To Score A Better Deal On Your Home Loan

How Many Credit Checks Before Closing On A Home Big Valley Mortgage

10 Common Mortgage Mistakes To Avoid Experian

How To Shop For A Mortgage Without Hurting Your Credit Score

How To Shop For A Mortgage Without Hurting Your Credit Score Mortgages And Advice U S News

Uk Mortgage Statistics 2023 Mortgage Facts And Stats Report

How To Shop For A Mortgage To Get The Best Rate And Lowest Fees

Understanding Seller Concessions Har Com

How To Shop For A Mortgage Without Hurting Your Credit Bankrate

How To Shop For A Mortgage Without Hurting Your Credit Supermoney

Rent To Own Furniture Appliances Electronics And Computers From Easyhome Ca

Mortgage Rate Shopping 10 Quick Tips To Score A Better Deal On Your Home Loan

How To Shop For A Mortgage Without Hurting Your Credit Score Ownerly Newsbreak Original